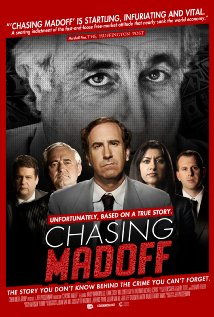

Few figures have reached the level of extreme notoriety like Bernard Madoff. In 2009, he became the face of Wall Street corruption, a financial super villain who pled guilty to orchestrating a $50 billion Ponzi scheme that affected everyone from large firms to individual investors. But as the documentary Chasing Madoff illustrates, for every villain there’s a hero, and the crusader in this case is Harry Markopolos.

Written, produced and directed by Jeff Prosserman, the film shows how Markopolos went from crunching numbers at a Boston firm to becoming the lead whistleblower in one of the biggest white-collar crimes in U.S. history. He first suspects the financier of fraud in 1999, but when his calls to action go unnoticed, he winds up the head of a frustrating decade-long investigation. Along the way, Markopolos assembles a dream team of experts that include colleague Frank Casey, business journalist Michael Ocrant and corporate lawyer Gaytri Kachroo, all of whom work together to bring Madoff to justice.

Over the course of 90 frenetic minutes, those involved explain how, despite extensive evidence and their exposing him to authorities and the media, Madoff managed to elude the feds and continue to fleece innocent people. While their story intrigues, the stock market does not, so one redeeming aspect of the film was its ability to make business sexy. Its style strays from the formalist conventions of the genre, as interviewees are flicked on and off screen like pages on an iPad and random images are delivered in smash cuts that would make Darren Aronofsky proud. To emphasize the crime drama element, subjects are also presented against a black background with patterned lighting, which contributes to a surreal film noir feel.

For the layman, the exact details of Madoff’s crime are laid out in easily understood metaphors and graphics. “You don’t get straight lines in finance! It never happens!” exclaims Markopolos, who stands in the foreground of a graph where the line representing Madoff’s growing revenue stream soars above those representing the average. Stock figures and market behavior are replaced with batting averages and horse races, and the devices simplify the issue without condescending to viewers.

The quick pacing becomes bogged down, however, when the story focuses solely on Markopolos. There’s no doubt that he’s the central character (the film is based on his book No One Would Listen: A True Financial Thriller, after all), but do we really need to visit his childhood preparatory school, sit with his parents or hear about his military career in order to understand what shaped him into the crime fighter he is today? The adulation becomes even more gag-worthy during footage of his testimony before the United States Congress, which shows house committee members staring pie-eyed in admiration as Markopolos criticizes the SEC for failing to protect investors.

There are also a number of dramatizations, many of which verge on the bizarre – in one, Markopolos, an avid hunter, shows his two young sons how to track animals, only to launch into a symbolic speech about the relationship between predator and prey as he inspects a pile of deer droppings. These scripted moments add nothing to the story and only serve to degrade the seriousness of the subject matter.

Under all the flash, however, is a film that only seeks to answer the question How did this happen? Citing major oversights on the part of the SEC and other institutions, Markopolos champions himself and his team as the only ones who knew from the beginning, and their perspective is crucial to understanding the case. But as history and Chasing Madoff shows, it was the 2008 market crash – not their actions – that eventually outed Madoff, making Markopolos and company as much the victims of his scheme and the system as the rest of us.

Chasing Madoff is now on VOD.